Consensus is Almost Always Wrong

Investors are making a dangerous assumption that skies are clear when it's the calm before the storm.

Good Morning - Fed cut imminent, recession abated, Mideast ceasefire talks ongoing, and Yen Carry Trade unwind complete so stocks to the moon right?

François de La Rochefoucauld said “humility is the worst form of conceit.” He might have replaced humility with consensus. Sentiment-only driven rallies end in sudden sentiment-reversal panics and that is where we are headed in the near future.

Sentiment-only driven rallies end in sudden, sentiment-reversal panics.

Consensus views are almost always wrong, especially when they are completely lopsided. Let’s run through the prevailing assumptions driving market sentiment now:

Interest rates are coming down

Inflation has been defeated

Geo-political risk is contained

A recession has been averted

Fiscal risks are manageable

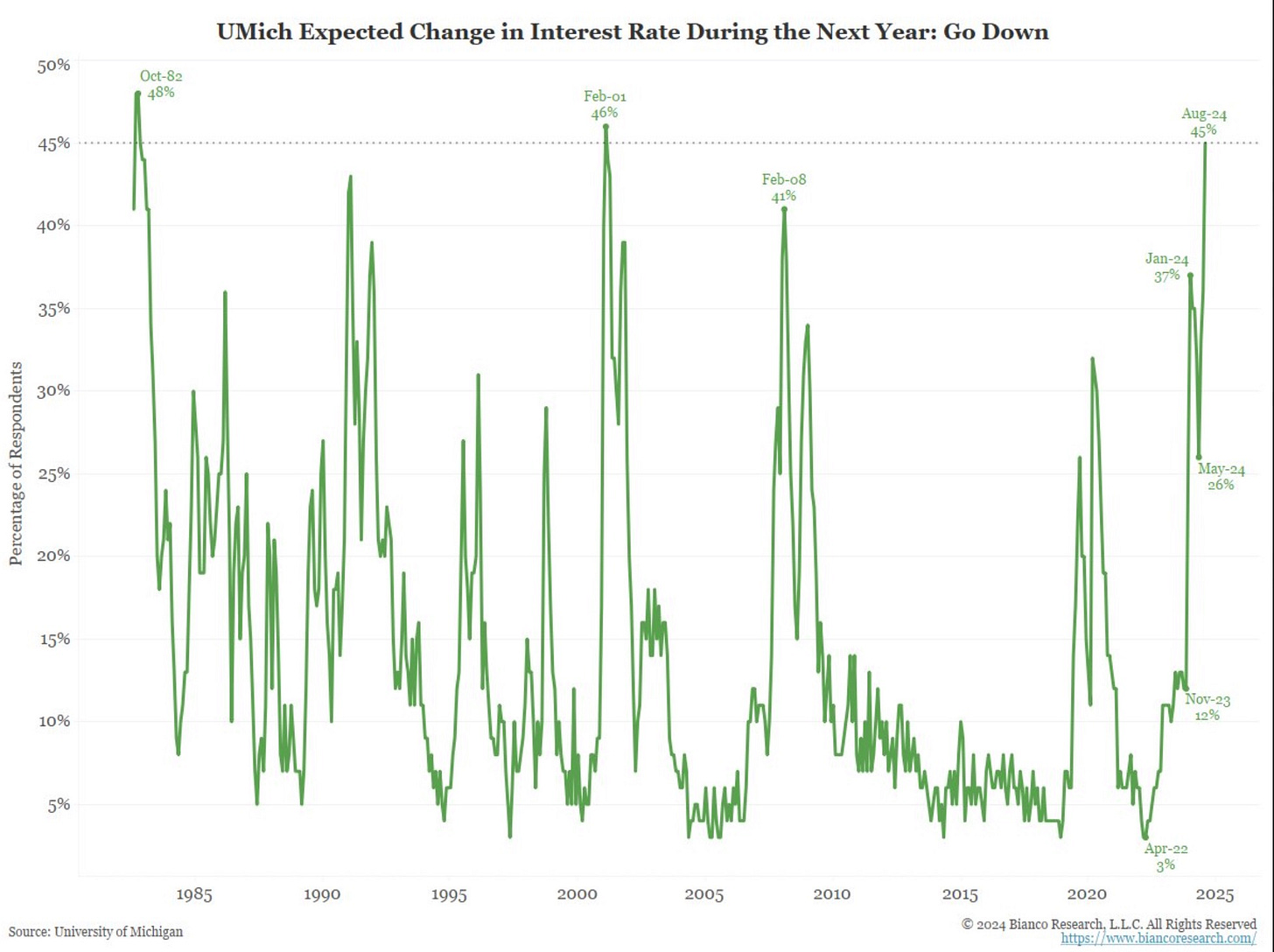

Over 90% of institutional investors believe rates will come down in the near future and so do average Americans (see below). Of course, these surveys express hope more than analysis. Interest rates are not a function of Fed policy, they are a function of the market. Ultimately, inflation always produces higher rates as the cost of capital goes up because of the economic slowdown caused by inflation.

Thus, it is easy to understand that as long as the continuation of monetary depreciation is expected, the money lender demands, and the borrower is ready to pay higher interest rates.”

Ludwig von Mises in 1923 at the peak of the German inflation

Inflation remains high even if rates are low. Average households are paying substantially higher grocery bills than they were even 12 months ago and that is unlikely to abate anytime soon. Then there is the price of gasoline. Oil prices have come down since ‘22 but hot war between Israel and Iran will reverse that quickly and substantially because global supply chains are far more fragile than most believe, especially the Straits of Hormuz (SOH) where 20% of global supply transits open daily. Iran could shut down the SOH in a pinch.

Recession or worse looks more likely not less and lowering rates may not be so stimulative this time because so much debt is already locked in at lower-fixed rates (See video here). Further, consumer savings are low, credit card, auto, and student debts are sky high (see below), and lower rates cannot fix structural indebtedness built up after recent decades of low rates.

US debt ceiling theatrics are back come January. Currently, US government (USG) debt continues to skyrocket and the pace is picking up whatever rates do. Regardless of how the election turns out there will be more spending and that means more supply dumped into shrinking demand so yields will continue to rise as demonstrated in recent auctions (USG will have to pay more interest to entice bond buyers). Investor sensitivity to recession signals is spring loaded and could trigger a major pull back since most assume no recession is coming. Stocks falling significantly (>20%) will crush tax receipts and explode deficits even higher, possibly above $3T.

US debt continues to skyrocket and the pace is picking up whatever rates do.

Market Tug of War

A tug of war between economic data and rate cuts is about to ensue, which means more volatility. Market sensitivity to geo-politics and the November election is increasing by the week and monetary injections are losing juice since much of Fed rate cuts have already been priced in (markets expect it). Plus, the global economy has been sufficiently benumbed after years of stimulus as I pointed out last week.

My forecast: a short-term knee jerk reaction to the upside that will last a few weeks followed by sudden pull backs of increasing velocity until recession (or exogenous shock) pulls markets down. So expect significant push-pull until there is a decisive break lower. Bitcoin and crypto will follow in lockstep.

Expect significant push-pull in markets until there is a decisive break lower.

Inflation or Deflation?

Another suspect consensus view is that governments will always CHOOSE to destroy the currency (inflation) rather than fiscal discipline (default). In reality, one equals the other. Results follow the same path: an inflationary spike followed by a massive depressive episode leading to default (Argentina, Germany, PIIGS etc). The same is unfolding in Japan and US is in early stages.

“But since 2021, 7 to 15 million migrants have entered the country (depending on your source), so the "delta" of under-the-table employment could be surging. We have no stats on this to say for sure.” Jim Bianco

The US economy is very weak beneath the surface. Economic scarring since Covid has been largely concealed by fiscal spending and wage suppression from cheap labor (illegal immigrants) but investors will soon figure this out. If a bump in the road triggers recession assets will fall rapidly (deflation), wiping out net-worths into a stubbornly inflationary economy. Folks will be hit with higher cost of living while their wealth evaporates as stocks fall. Double whammy.

Buckle up because reality is bearing down on us like a freight train, which is why gold is rising fast. Bottomline, we are headed into a financial emergency that will destroy old paradigms and pave the way for news ones.

Welcome to the End of Cycle.

Stay safe, stay liquid.