The Danger Zone Economic Theory Cannot See

A slow motion economic catastrophe is in progress and we need a new economic paradigm to recover

Economic theory cannot explain the global economy today. Currencies are breaking (Yen, Argentine Peso), inflation is spiking in certain areas (food and energy), and deflation is striking in others (bank balance sheets / Commercial Real Estate (CRE). China - the world’s engine of growth since 2010 - is stable, in recession, in a pricked property bubble and growing all at the same time depending on what you read, and all could be true in a country of such immense size and scale. Interest rates are breaking out or set to fall, some think neither. At the center of the farrago are central bankers and Treasury officials clinging to economic orthodoxy like a safety line on a sinking ship.

In recent surveys average Americans disagree with official claims that the US economy is strong. The Fed, Treasury, and Wall Street maintain that unemployment is at record lows, that inflation has been deflated, and that consumer spending is robust but the rest of the country by wide margins feels very differently. While “feels over reals” is always a difficult web to disentangle, something far more dangerous is at work here. We are experiencing the early stages of a paradigm ending conundrum Thomas Kuhn would have called revolutionary, and I call End-of-Cycle.

Conflicting “realities” can be true, for a while. Wall Street continues to enrich itself by riding an increasingly narrow grouping of stocks led by Nvidia, US Government officials continue to see demand (albeit wobbly) for Treasuries, and Fortune 500 executives continue to see earnings climb. At the same time, people on the street are struggling, many (perhaps most) of whom live paycheck-to-paycheck, work multiple jobs to keep up, and are being squeezed by higher gas and grocery prices. Further, while bigger companies have faired well since Covid (at least on paper), small business (the lifeblood of the US economy) has suffered disproportionately. The resultant “wealth gap” is an issue to be sure, but the fundamental error is theory versus reality.

We are experiencing the early stages of a paradigm ending conundrum Thomas Kuhn would have called revolutionary, and I call End-of-Cycle.

For Americans, the US economy and the global financial system - what I call the Global Dollar System (GDS) have been inextricably linked for nearly a century. Control of the world’s reserve currency and international financial hubs (SWIFT, IMF, BIS etc.) guaranteed a closed-system of transactions settled in dollars, which meant that no matter how the US economy performed there would be a steady stream of investment in dollar-denominated-assets: NYSE stocks, US bank deposits, California real estate etc.

That was a rewarding trade-off for asset-holders, less so for the vast majority of Americans who saw middle class jobs disappear and the US economy lose its industrial edge. To plug the gap for average Americans, Wall Street collateralized real estate (MBS) and hooked consumers on credit cards so even as real-wages stagnated or fell John and Jane Smith maintained the fantasy of first world living standards none-the-wiser.

The GDS worked so long as three things were true: US consumers were strong, the US Dollar was weak (relative to others), and supply chains were global and frictionless.

As long as US consumers are strong, they can buy goods imported from producers like China

As long as the Dollar is weak then overseas input costs are low, keeping inflation in check in poorer countries where excess spending capacity is lower

As long as supply chains were global there would be no interruption to the flow of trade

Those pillars are breaking down because of inflation. Inflation forced the Fed to raise rates, and doing so has caused the dollar to rise (relative to others) and weakened US consumers. At the same time, increased geopolitical conflict is “friendshoring” supply chains. Consequently, the GDS, already weakened by Covid, is fraying at an accelerated rate. As obvious as this should be, current economic consensus has not figured it out.

The dominant schools of economic theory today are Monetarism (Neo-Liberalism) and Keynesianism. Both schools largely adhere to the same principles, namely that the monetary system is the epicenter of economy. Paul Krugman (an evangelical Keynesian) repeatedly says “my spending is your income” and Milton Friedman (father of Monetarism) said “inflation is always and everywhere a monetary phenomenon.” Perhaps the most religious testament of economic orthodoxy today is what Father John Maynard Keynes himself said last century: “credit expansion performs the miracle that turns stones into bread.” Such thinking has justified limitless expansion of central banking and fiscal spending, unleashing an explosion of debt the world has never seen, and ignoring the collateral damage it has done to the real (non-financialized) economy.

Both schools are also blind to the harm inflicted by dollar reserve status, a failure that rests squarely on anachronistic economic orthodoxy. The pro-free traders (Monetarists / Neo-Liberals) want America to run the old playbook: lower trade barriers, cut taxes, bring in foreign workers, and deregulate the financial system. Keynesians want more regulation, higher taxes, and even more government stimulus. Both programs assume USD reserve status is invulnerable, ignore the catastrophic consequences of financialization, and both offer no solutions to stop America’s economic decline.

Worse, the prescription for every major economic crisis we have faced since the Great Depression has been the same: Fed money printing (Lower Interest Rates + Quantitative Easing) plus fiscal spending (Stimulus Packages and Government Intervention). Famed economist and fellow Keynesian Hyman Minsky claimed that these policies worked as temporary fixes to restrain the volatility inherent in capitalism but he acknowledged in the long-term the Keynesian formula was self-destructive:

“What the Federal Reserve and the Treasury do to contain crises and abort deep depressions leads to inflation, and what the Federal Reserve and the Treasury do to contain inflation leads to financial crises and threats of deep depression.”

The spike in inflation has put the Feasury (Fed+Treasury) in Minsky’s bind, but it is the destruction of the GDS that is bringing it about. For the first time in a century the GDS is under threat. Foreign buyers like China and Japan are net-sellers of US Treasuries, and fear of sanctions is pushing more and more nations into BRICS and other non-Global Dollar System financial hubs (Bitcoin et al). China based Cross Border Interbank Payment System (CIPS) and Russia’s Financial Messaging System (SPFS) are small but growing fast, especially CIPS. Current usage rate is less important than the fact that scalable alternatives exist to SWIFT and other dollar-based-platforms. Outflows from the GDS so far are a trickle but gaining momentum, and will soon become a deluge.

Then there is the surge in gold. Gold has soared to new all time highs because Asian banks, specifically Indian and Chinese are buying en masse through Hong Kong. The shift in financial power from West to East is breathtaking:

Fully 25% of Russia’s Central Bank Assets are in Gold

The Shanghai Gold Exchange (SGE) stands to challenge the London Metals Exchange (LME) to set international gold prices

For the first time in over 30 years the Royal Bank of India (RBI) requested their gold back from London in the Spring

Such massive buying from Eurasia is happening for 4 main reasons: 1. to fight inflation; 2. Full Faith and Credit of USG is suspect; 3. Fear of sanctions and; 4. to prepare for a repeg.

There are widespread fears in Asia that inflation is out-of-control in America, and will only worsen overtime.

US fiscal spending is so outrageous that foreign fiduciaries cannot justify buying long-duration (2 Years+) Treasuries.

3. Equally, fears of potential sanctions, especially on China, are growing as geo-political tension rachets higher. The seizure of Russia’s bonds by European banks may soon be repurposed (stolen) to support Ukraine in the war.

Gold will be the escape valve through which the BRICS and potentially other international organizations de-dollarize.

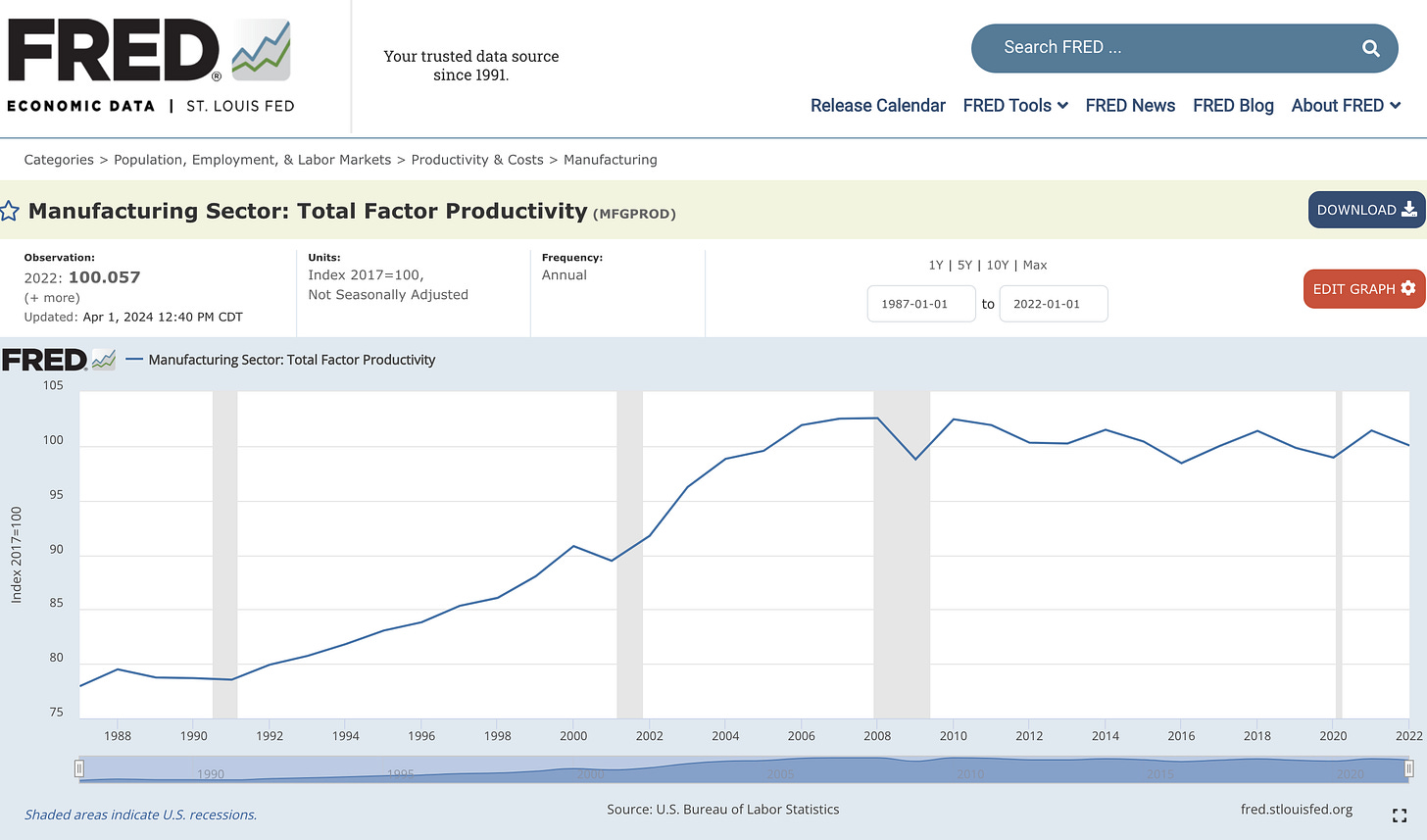

Worse, the GDDS has severely damaged the internal organs of the US economy. America’s lost industrial prowess (see below) is often cited along with the deplorable state of US infrastructure but what is less obvious is the egregious waste in private equity, the purported jet fuel for Silicon Valley’s innovation machine. Malinvestment in bogus companies like Theranos over the last decade plus adds new dimensions to “Ponzi Finance,” once more enabled by easy-money-policies and in turn enabled by the GDS. Capital has been allocated inefficiently and recklessly for decades and the AI craze promises to be just as bad.

What that leaves us with is government spending, the last major engine propelling the US economy. As it stands today, Americans are relying more and more on government spending, which is 40% higher today than before Covid according to the Cato Institute. As evidenced by employment numbers alone, the Federal government is leading in hiring and spending compared to most sectors except healthcare, which is heavily subsidized by government too. As a result, Americans are becoming more and more dependent on government while simultaneously seeing their standard of living collapse, especially the bottom 50%. How much longer can this go on?

USG spending is 40% higher today than before Covid according to the Cato Institute.

The Global Dollar System is collapsing from the outside in. It can be argued that Fed Rate hikes are bringing the rate of inflation down in some sectors but at the cost of bankrupting companies (see below), squeezing households, and destroying bank balance sheets (“unrealized losses”). US banks in particular are under strain as is CRS whose real valuations are aggressively repricing downward (“marked-to-market”). Bank loans (“assets not liabilities”) are worth the diminishing cash-flow they are generating and commercial property is worth what buyers / renters are willing to pay right now; in most cases, substantially less today than before, and it stands to get much worse.

If you add it all up, banks are under stress, foreigners are de-dollarizing or prepping to do so, and US consumers and small business are in trouble. To paper over these troubles we go back to economic theory. Governments are spending (Stimulus), and central banks stand at the ready to print and or hike as the case may be, none of which will resolve the problems inherent in the Global Dollar System. The Neo-Liberal prescription to reinvigorate the Washington Consensus is equally counter-productive.

In sum, we need a new economic paradigm, one that acknowledges the catastrophic situation we find ourselves in so that we can fashion new solutions (industrial policy, labor policy), embrace new currencies (Bitcoin), and a new post-Dollar financial system (De-Fi) to fix it. Tragically, economic orthodoxy will prevail until a paradigm ending disaster invalidates it, one that I believe is in progress.

Stay liquid, stay alert.