Gold BRICS+, Broken Bonds, and End of Cycles

The collapse of America's Monetary Empire is upon us.

Good Morning - the world is changing at breakneck speed. The East is rising, the West is flailing, and new, unprecedented global alliances are congealing (BRICS+) while others are fracturing (EU-NATO). Despite the gravity of these changes the voting masses in America are turning their ever-shortening attention spans to political media, national polls, and presidential betting markets. The perennial claim that “this is the most important election in our lifetimes” is good marketing but November’s winner is background noise as the end of a monetary cycle approaches.

Three variables are converging that are inverting the monetary order root-and-branch.

First, the rise of BRICS+, the first monetary-trade alliance of its kind and scale outside the West post-WWII

Second, the resurrection of gold as the escape valve for Asian bankers and BRICS+ policy architects who have designs on repeging fiat currencies and leveraging the precious metal as international trade collateral

Third, the fiscal crisis wrecking Western economies, which is beginning to show in unstable bond markets

All three colossally important trends garner little more than dismissive yawns from Western elites whose reckless arrogance, delusion, and warmongering continues to be their undoing.

BRICS+ and Mortar

Let’s start with BRICS+ who just convened another important Summit in Kazan, Russia. Some 36+ nations gathered to reaffirm the burgeoning trade union’s commitment to restructuring the global economy and pushing back against Western interference. Essentially, the union is being driven forward by Russian diplomacy, Chinese industrial-economy and supply chains, voracious emerging markets, and a collective desire from the Global South for a monetary overhaul.

The muscle of BRICS+ shows itself in terms of population, supply chains, and resources. Core regional economies like China and India have massive populations and resource rich nations like Brazil, Iran and soon-to-join Saudi Arabia stack bioenergy and fossil fuels in their favor. BRICS+ are unanimous that the current global economic order governed by flailing Bretton Wood’s institutions and the US dollar have become obsolescent, restrictive, and harmful to the world’s economic interests.

Why is BRICS+ persistently dismissed by the West? The lion share of the blame belongs to what Mohamed El Arian politely calls “a lack of cognitive diversity.” Ultimately, the progressive fanatics who make western policy do not understand much beyond ideological talking points. The road to utopia - what they call “global governance” - is paved through post-World-War-II Western international, democratic institutions, so anything else is a threat.

Western technocrats are blind to Asia’s massive industrial leap forward and befuddled by the Global South’s turn towards locally driven trade and transaction.

As a result, Western technocrats are blind to the deterioration of deindustrialized Western economies, short-sighted about Asia’s massive industrial leap forward led by China, and befuddled by the Global South’s turn towards locally driven trade and transaction. By contrast, Asians, Africans, and South Americans are rightly quizzical as to why they need to route monetary transactions through parasitic New York or London banks with approval from temperamental ideologues in DC or Brussels.

Golden BRICS+

Onto gold. Gold is not an asset class, it is a monetary system. The gold price is quite literally a measure of the emergent financial system and a shift in monetary power from West to East since 2000. Gold's ascent really began when the Shanghai Gold Exchange (SGE) launched in 2002. The CCP encouraged Chinese citizens to own lots of gold and so they do in large quantities. Later, the SGE became international (SGEI), and today surpasses the London Metals Exchange (LME) as the world's most important metals exchange.

BRICS+ has become gold’s monetary network while SGEI has become gold’s central bank.

To most of the world gold is money. Asians (+others) in general are stockpiling because they know the dollar-fiat-system is failing (inflation), and gold is a substitute for treasuries (debt), which is little more than a toxic derivative at this point. So BRICS+ has become gold’s monetary network while SGEI has become gold’s central bank of sorts for future trade. These two components reveal the structure of the next monetary system, a multi-polar system devoid of a singular world-reserve-currency.

Russia was essentially a proof-of-concept for how to escape dollar supremacy

Russia’s invasion of Ukraine accelerated this development. Russia's economy and banking system not only survived but thrived under the predictable battery of US sanctions. How? Because they owned lots of gold, sold Treasuries and were rich in commodities (as are BRICS+) the world needs. Russia was essentially a proof-of-concept for how to escape dollar supremacy so the rest of the world took notice and appears to be mimicking with enthusiasm.

Bonds are Melting Down

I have written about the bond market for some time because that is where the breakdown in the dollar-system will happen in my view. We saw early signs of this in 2020 when the Treasury market ruptured because of a fire sale into liquid assets. The next warning came in Fall 2022 when the UK Gilt’s market nearly collapsed. Perhaps the final bellweather was Silicon Valley Bank’s implosion in 2023 because of hoarding too many long duration Treasuries.

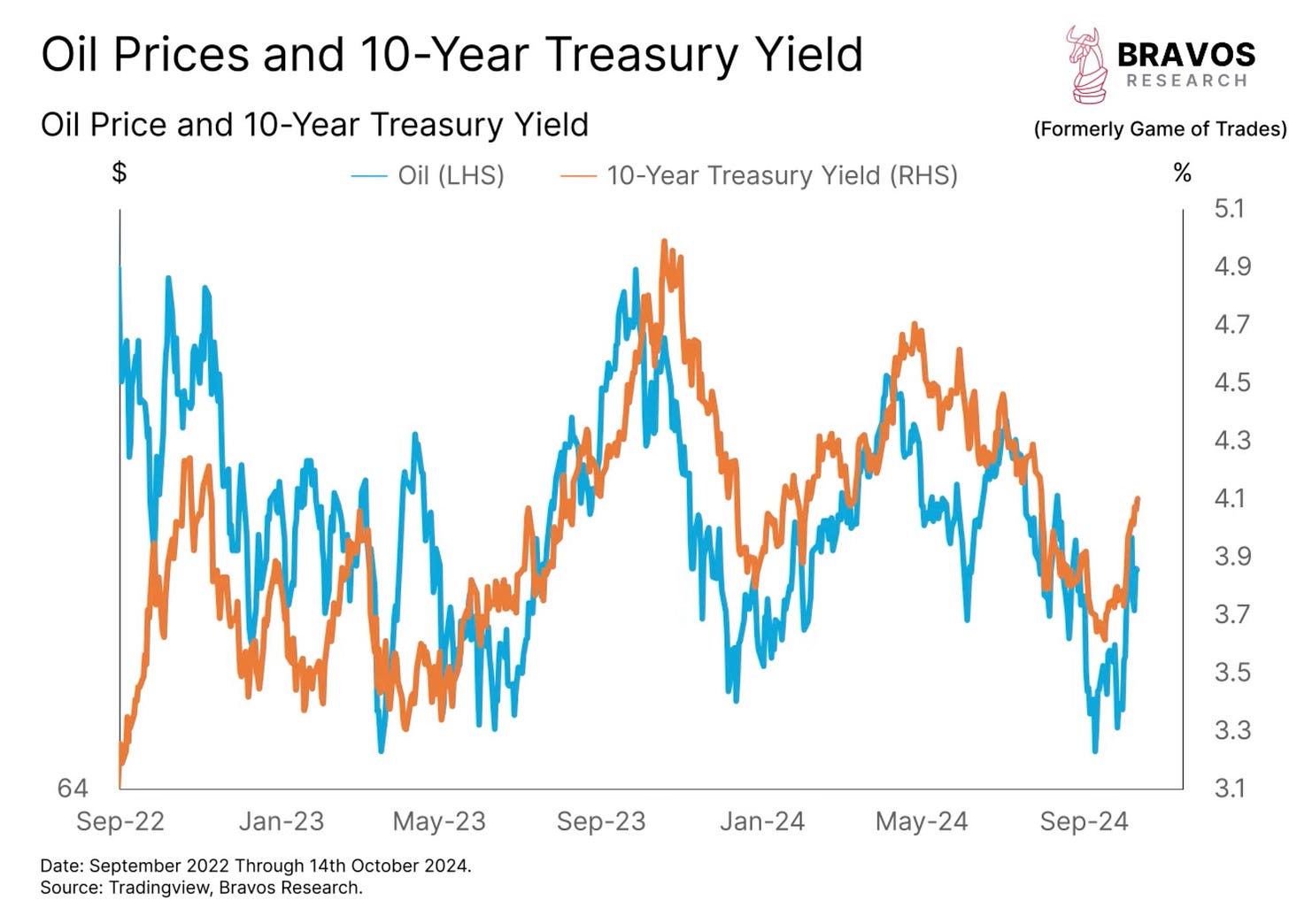

The problem is too much debt. Fiscal deficits in the United States stand to be $2T+ for the foreseeable future, the USG is adding about $1T to the national debt every 100 days, and regardless of who becomes president there are no plans for serious spending cuts. However, the October surprise of 2024 so far has been that bond yields (interest rates) continue to rise despite Fed rate cuts. Why? Because markets won’t accept fiscal irresponsibility on this scale.

The October surprise so far has been that bond yields continue to rise despite Fed rate cuts.

Yields are rising across western bond markets because structural debt (entitlements and unfunded liabilities) is simply overwhelming. There is far too much debt issuance, fewer and fewer buyers, and a vicious cycle of higher rates for higher debt appears imminent. Remember, monetary tools and fiscal stimulus are inputs to complex economic systems, they are not outputs. Market forces ultimately digest and interpret these actions and higher yields signals that Mr Market is beginning to lose confidence in monetary authorities.

Wars End Cycles

The death of the dollar-system would not be complete without an end of cycle conflict. As the brick and mortar of the next international system is being laid bare new lines of military defense are being erected by the Global South. Unfortunately, as demonstrated in Ukraine, thus far US strategists have discounted global supply chain vulnerabilities if full scale regional war(s) breaks out, especially for key commodities.

US strategists have discounted supply chain vulnerabilities if full scale regional war(s) breaks out.

Top of the commodities directly impacted is oil. The complacency about global-supply-demand imbalances for oil among western investors and policymakers is truly irresponsible. The fact that the US Government (USG) was forced to drain the Strategic Petroleum Reserve (SPR) by 50% just two years ago to ease prices at the pump is ancient history. Imagine the consequences of major disruption to global oil markets if war between Israel and Iran spreads to the entire region. Unfortunately, Western governments are not taking such a possibility seriously for three main reasons:

First, the West is downplaying the human tragedy in Ukraine, Gaza and now Lebanon and their global impact on Western credibility

Second, Brussels is silent and DC is complicit in Israel’s belligerent escalation against Iran, which could lead to a nuclear exchange

Third, cognitive delusion about the true state of Western economies (and societies), especially the US

Ultimately, oil remains the most important commodity in the world because industrial-economy and first-world standards of living depend upon it. Historically, speaking, oil price spikes time recessions and forecast higher bond yields. Israel’s war with Iran will almost certainly devastate oil markets by disrupting key producers like Iran (and OPEC members) and key supply routes like the Straits of Hormuz.

Without question, higher oil prices will plunge the US and the global economy into an even worse recession and likely blow up western bond markets at the same time, never mind second and third order effects. Could there be a full blown energy crisis in world, in the United States? What about global trade and supply chains?

Higher oil prices will plunge the US and the global economy into an even worse recession and likely blow up western bond markets at the same time

What madness has brought us to the point that Western nations already besieged by existential domestic problems (immigration, polarization, poverty,) are flirting with war at the precise moment when BRICS+ is coalescing into an alternative monetary-economic powerhouse that stands to benefit from any major confrontation? Then again, empires go out with a bang rarely a whimper. It looks like America’s Monetary Empire will be no different.

Welcome to the end of cycle.

Stay liquid, stay alert.

No longer if, but when -- dies that sound about right, Cameron? The issue then being : how to navigate a way through, for yourself and those you love and influence. If you can lead a few other souls to discern the wood for the trees, even better. Keep on keeping on!

Well written. I don't see how our sovereign debt, & largely avoiding any public rhetoric about it, doesn't end in an empire collapsing crisis. It's not as if this hasn't been observed before, historically.