Gold's Rise is a Warning

The entire banking system is facing an existential crisis and that is why gold is skyrocketing.

Good Morning - Yes - gold is rising, but why?

Some thoughts and warnings are in order.

Gold is up 30% this year alone, currently hovering at all time highs and a market capitalization around $18T, a truly colossal explosion.

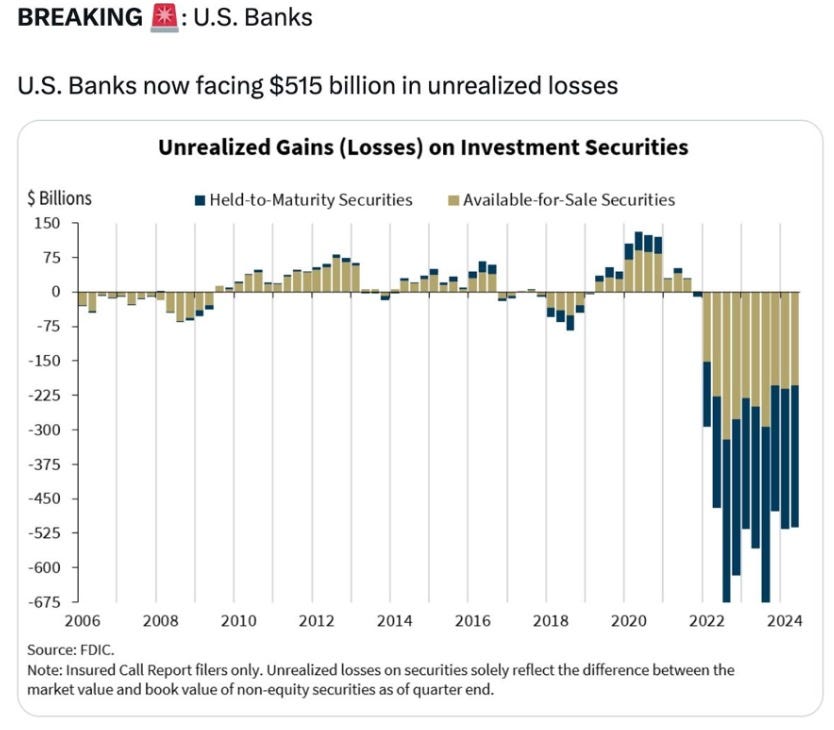

There are many tail winds propelling gold upwards but one that is being flatly ignored is the worsening US banking crisis (see below).

In September, the Fed cut rates substantially and they plan to cut more before Christmas, which has prompted a chorus of applause from market makers and analysts who believe low rates are here again. Wrong.

So far the opposite has happened. Bond prices have fallen while yields (interest rates) have surged, moving in the exact opposite direction of what consensus would suggest.

So what?

The problem is "unrealized losses" (currently $500B+ and rising) Since 2008, the US Government (USG) has leveraged bank balance sheets to prop up its spending. Dodd-Frank forced all the big banks to gorge on US Treasuries (never mind other holes from deteriorating asset-backed securities (ABS)

Yesterday's pristine collateral is today's toxic debt. The trouble is big banks, especially Bank of America (BofA) are carrying ever-growing losses on their balance sheets, the very same imbalance that broke SVB in spring ’23.

Why are yields rising? Yields are rising because of too much government debt (and debt in general) combined with slowing growth. Remember, fiscal spending is set to explode next year regardless of who becomes the next President.

To make matters worse, Iran-Israel escalation to full-scale war is worsening by the week. Once markets realize a full-scale regional war has already begun oil prices will rise, and eventually spike if major fallout disrupts the Straits of Hormuz supply route or OPEC production.

Who cares?

Oil spikes time recessions and tend to auger higher bond yields. Higher yields means more unrealized losses until banks blow up.

So what? The Fed will just bail them out?

If the Fed is forced to bail out big banks like BofA it will shock financial markets and send the entire global banking system into a frenzy.

Remember, the banking system and financial markets in general are confidence games. Confidence in the Fed was dealt a serious blow by their "transitory inflation" foible (among others) in '21. A sudden, unexpected banking crisis will break it completely.

In short, the entire banking system is facing an existential crisis and this is a fundamental reason why gold is sky rocketing.

How high can gold go? A better question is, how much wealth destruction will there be as the legacy banking system unwinds?

Somewhere in the ashes will be a new monetary order. A new system is already taking shape in the East backed by gold and most likely in the West a new Bitcoin based-monetary system is far more likely than most believe.

Stay liquid, stay alert.