Make No Little Plans

Trump's incremental reforms are far too little, too late.

Good Morning - Resignations are often harbingers of disaster.

Janet Yellen is sunsetting as Treasury Secretary and has resigned as a Member of the Board of Governors of the Fed.

She was widely celebrated by the Gerontocracy for her academic credentials, doctrinaire Keynesian myopia, and for promising the end of financial crises in “our lifetimes” under Fed leadership. However, her legacy and that of the Feasury (Fed + Treasury) will be Activist Treasury Issuance (ATI).

ATI (front loading bond markets with short-duration TBills instead of long bonds (+10Yr) to avoid rate spikes), like QE, was yet another reckless gambit used by fiscal authorities to mask the debt crisis overwhelming the US Government (USG) since 2020.

Why 2020? Because that is when inflation resurfaced with a vengeance and subsequently when interest rates, which rise with inflation, began to skyrocket. This was not the Fed's doing as much as market forces.

Potemkin fiscal cuts will not stave off fiscal catastrophe.

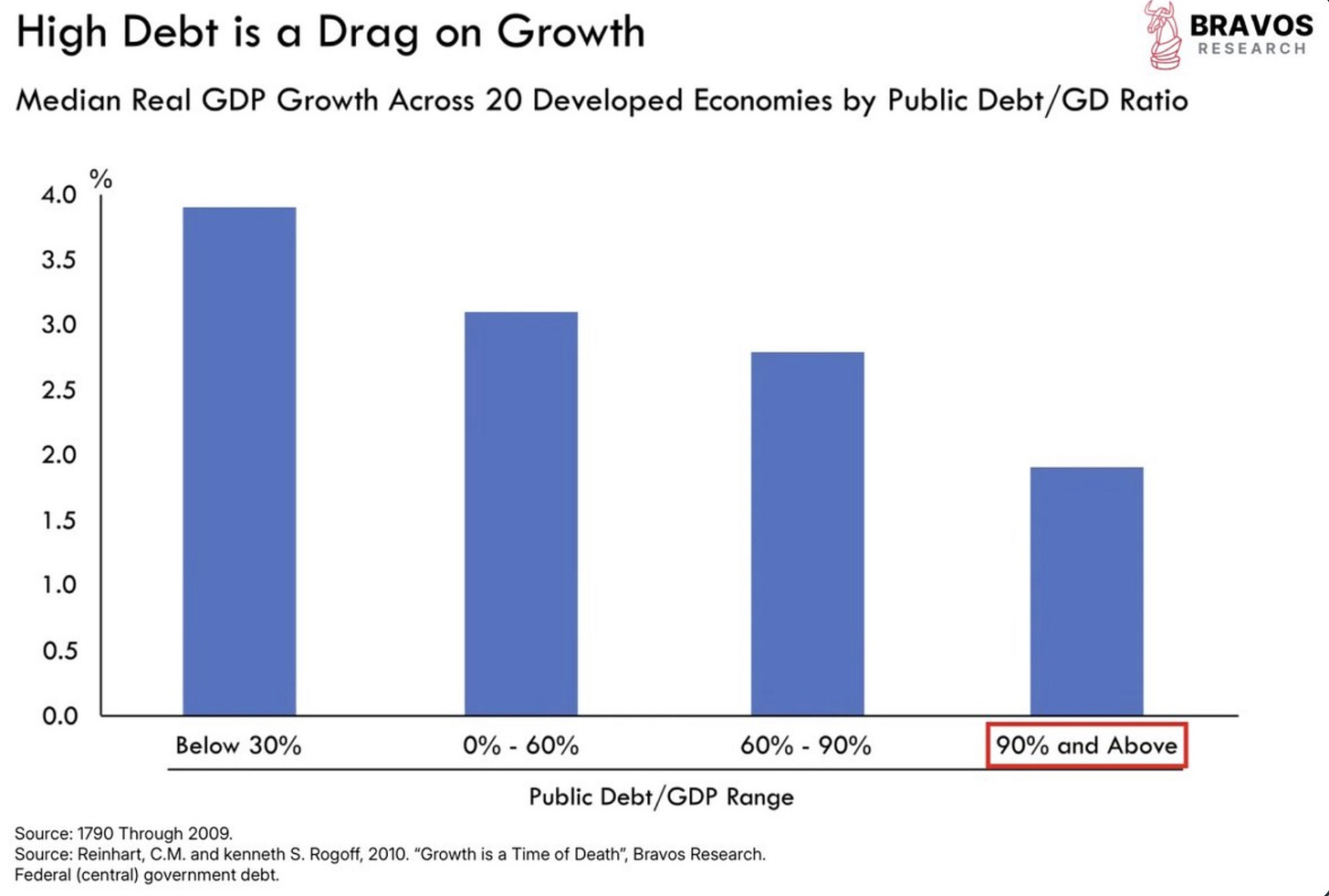

Something bigger is afoot here than partisanship. Trump's ever delusional supporters think Scott Bessent's macro-musings and some combination of haphazard tariffs, juiced oil production, and Potemkin fiscal cuts will stave off fiscal catastrophe.

News flash, flaccid reforms won't work either and will only push rates higher (see UK). Yellen's fiscal gerrymandering like the Fed's rate cuts and Trump's blustering will utterly fail because what America needs is structural reform, not virtue signaling.

What America needs is structural reform, not virtue signaling.

Structural reforms always cut deep and from a fiscal stand point it means an overhaul of entitlements, gutting defense spending, and smashing special interests like Big Pharma and AIPAC who carve up tax payer dollars like cadavers for the Red Market.

Interest rates are rising and fast, which puts the USG in a bind. The good news is that crisis (from Greek "krisis" meaning decision point) will force binary decisions.

For the moment, Trump hopium represents the illusion that marginal reforms like cutting the fiscal deficit to 3% of GDP by 2028 (what a joke) will set America back on track. It's "morning in America" again so they hope. (Look up the Grace Commission for more on that sophistry)

Trumpism is the "fat pill" that artificially cuts weight by destroying your digestive system ("side effects") rather than diet, exercise, and painful adjustments to daily habits no one wants to drop.

Market forces will jolt Trump Hopium like AstraZeneca stock. NYSE Trump rally is the fake out before the big crash worthy of a Crypto shitcoin.

The USG faces a clear choice: impose structural reforms proactively or impose structural reforms reactively.

The lesson from Yellen's chicanery could not be clearer, “its time to pay the piper.” The choice before the USG is clear: impose structural reforms proactively or impose structural reforms reactively.

Trump and his cohort can either lean into root and branch reform on difficult but manageable terms, or wait for a bond market meltdown that will “test social cohesion.”

Monetary history and Trump’s posturing so far suggests they will choose the latter.

Bond yields, mortgage rates, credit card rates etc. are moving higher and all for the same reason, the borrower is no longer creditworthy.

Empires rise and fall but debt is undefeated.

Welcome to the end of cycle.

Stay liquid, stay alert.

Great article as usual, Cam.