Debt Supernova: This Time is Catastrophically Different

The US is entering into a debt doom loop far worse than most believe.

What bedevils the masses is always what they assume to be true but know to be false. Nowhere perhaps is this stark reality more dangerous than in the US Government’s (USG) rapidly deteriorating finances.

America is not headed for a fiscal crisis, we are living through one.

Despite mainstream claims otherwise, America is not headed for a fiscal crisis we are living through one. Indeed, the USG is in the early stages of a default spiral that will likely destroy or at a minimum substantially re-value the US Dollar (USD). Some statistics bear repeating to illustrate the extent of the deterioration:

The US Government (USG) owes somewhere between $175T and $200T all included (current + future liabilities)

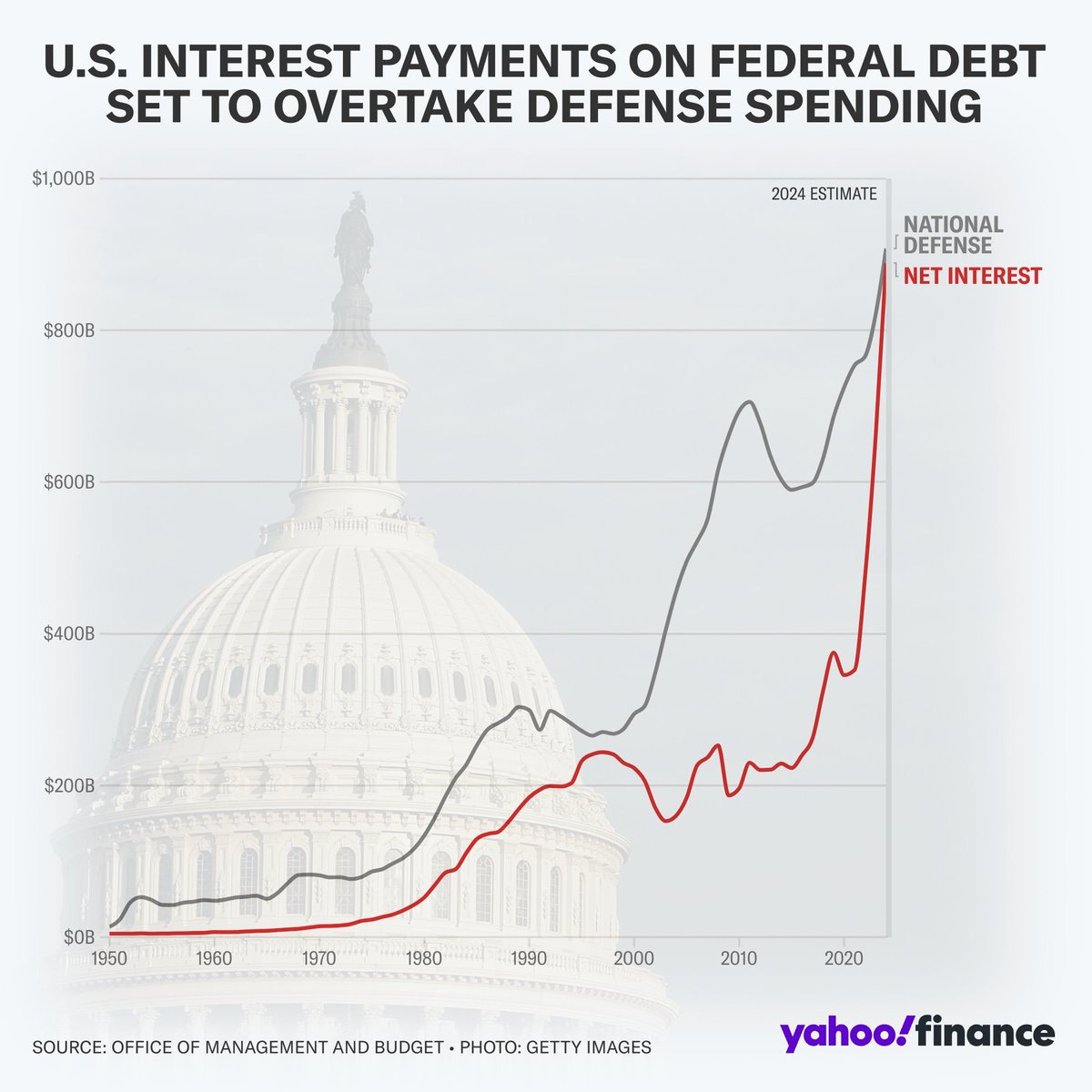

Interest expense this year (2024) will surpass defense spending and soon become greater than entitlements (see below)

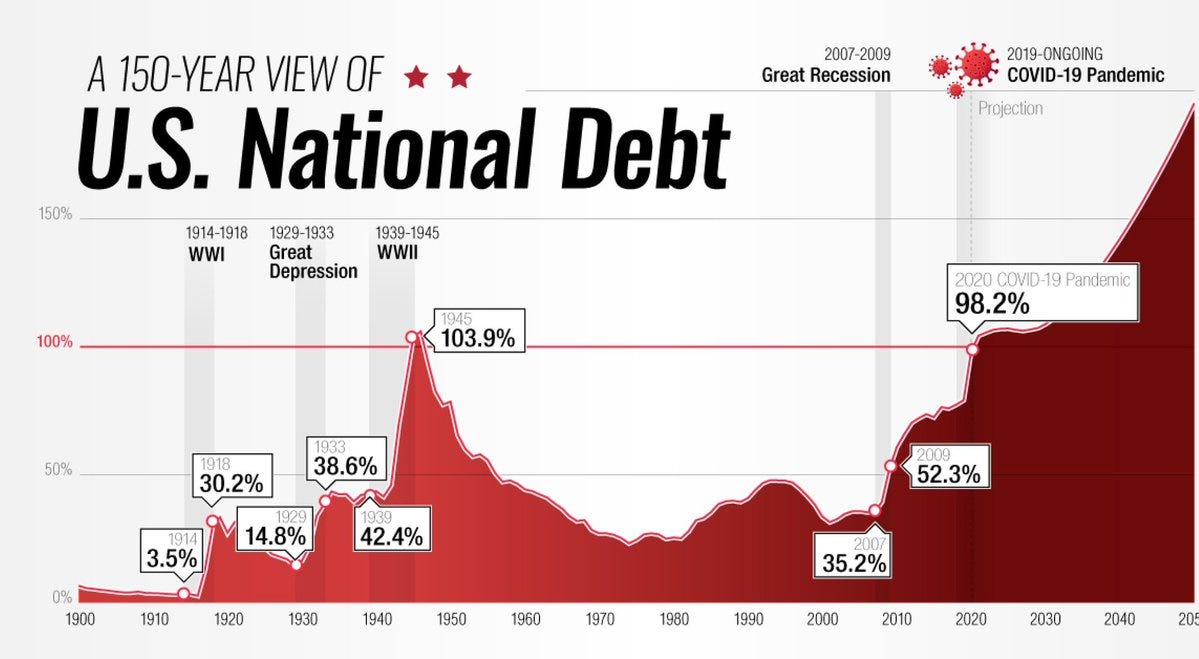

Over the last 4 years, US national debt has skyrocketed by $11.6 trillion while the US has added $6.6 trillion in GDP

The dollar has lost at least 25% of its value since Covid

I could go on but I think you get the point. As scary as the figures above are the national debt has been an elusive boogeyman since the 1980s and earlier so why does it matter now compared to then? Why can we not simply print indefinitely? At first blush, these may appear to be facile questions but they are extremely relevant because they rest on certain assumptions virtually institutionalized inside America’s Gerontocracy.

A useful exercise is to examine the underly thinking that “printing money” indefinitely is possible and therefore the USG is in no imminent danger as a result.

USG Debt is Limitless Assumptions:

Nations who print their own currency cannot default - this is a common misconception belied by historical fact. Nation’s have defaulted many times before, including great powers who devalued their currency in one way or another: France 1790’s, Germany 1920’s, Great Britain 1930’s, USG 1970’s. Default simply means obligations are not paid or are “restructured.”

As a corollary, a sub-assumption is that governments are immune from default because they have taxing authority. Of course, taxing authority is irrelevant if economic productivity is suffocated by fiscal debt (see crowding out effect), or if the population rejects further taxation. Both trends are strong today.

The Federal Reserve (Fed) can always lower rates and print money - The Fed (or any central bank (CB) operates as an input to the financial economy by buying or selling assets largely through the banking system. Sometimes, as in the case of Japan, CBs have bought stocks, corporate bonds or become the majority stakeholder in government debt (BOJ owns 50% of Japanese Government Bonds (JGBs). However, they are not an output, meaning they can only marginally influence the supply-demand curve or investor confidence, and sometimes their policies are counter-productive.

For example, lowering rates was intended to spur spending post-2008 but instead it forced savers (largely Baby Boomers) to horde cash to achieve the same level of savings returns. Lower rates also push investors into riskier assets that pay out more yield but often blow up when underlying assets collapse in value (sub-tier real estate derivatives for example). These distortions usually pump markets into unsustainable bubbles that inevitably burst with severe consequences.

If the economy stalls, investors will flee into US debt for safety - A common misconception you will hear is that if anything goes wrong, investors, both foreign and domestic, will buy USG bonds because it is the safest place to put money. Such an assumption is the basis for the so-called 60:40 portfolio, a strategy based on the last 40 years when bond yields were low, the economy was robust, and America was the most powerful country in the world. Needless to say the world is completely different now. When recession strikes next the federal deficit will blow past its current $2T threshold because tax revenue will fall, a strain that will push interest rates even higher as markets perceive the USG an even riskier investment. Large foreign investors especially will be even more reticent to invest in the US because of escalating geo-political tensions.

Governments and CBs are the final arbiters, not markets forces - The market expression for this sentiment is “Don’t fight the Fed” a powerful and nonetheless false belief soon to be exposed. Equally delusional is the idea that the government can just bail out banks again if there is trouble. Ultimately, as Japan, China, and many other world leading economies with powerful CBs are discovering concurrently they are only marginal inputs to market forces. If investors panic, if speculators smell currency weakness or government insolvency no fiscal authority can resist, as was demonstrated during the Asian Financial Crisis in 1997 and the collapse of the British Pound in 1992.

An ancillary rebuttal is that currencies are whatever governments say they are so if the USG bans Bitcoin or Gold it can prevent people from exiting the currency. Such measures have been tried and failed many times from China and Argentina to Nigeria. When governments default and currencies falter people tend to exit the currency regardless of what governments do. More often than not two economies emerge, one regulated by the government and a black market where alternative currencies are transacted.

De-dollarization is functionally limited - American politicians, policy-makers, bankers, investors, average Americans etc. believe that the dollar and USD denominated assets are central to the global economy because the vast majority of international trade is settled in dollars. Indeed, dollarization maintains a steady flow of international capital into US assets, including and especially US Treasuries (USTs). However, while the dollar’s dominance in world trade remains strong, there is no compelling reason why USD needs to be used, which is why BRICS+ (see more below), and bi-lateral agreements to settle trade in local currencies are becoming common place.

Inflationary pressures make the dollar’s position even worse. As I have written previously, the DXY is rising relative to other currencies as interest rates are rising so there are fewer and fewer dollars available. As a result, inflationary pressure is surging in the non-Western world, forcing foreign governments to sell USD to protect local currencies from collapsing. Japan is perhaps the gravest example of this.

There is No Alternative (TINA) to Western Financial Institutions / Assets - Since sanctioning Russia in 2022, alternative financial institutions including but not limited to Russia’s SPFS, China’s CIPS, Project mBridge are gaining serious momentum. Specifically, BRICS+ is paving the way by establishing trade relationships among the world’s largest energy producers, which anchors the alliance in economic resources over which the United States holds no sway. Westerners tend to dismiss these developments because they argue BRICS+ lacks trust among its members. Ironically, a lack of trust in Western institutions is what has triggered the race to de-dollarize more than anything else. As Vladmir Putin said, “The West’s attempts to isolate us have only strengthened our resolve to create a financial system independent of the dollar.”

“The West’s attempts to isolate us have only strengthened our resolve to create a financial system independent of the dollar.” Vladmir Putin

“Our grandkids will have to pay back the debt” - We have years or decades before it strikes has been a talking point for years to allay concerns about debt. However, implicit in this statement is a slow grinding down of the currency until Quantitative Easing to Infinity (QEI) mutates into hyper-inflation. It is the case that inflation has been almost imperceptibly slow since 1971. However, once debt exceeds 90% of GDP the financial system becomes very unstable. Debt = risk, and risks multiply exponentially as you add tens of trillions in liabilities to the fiscal balance sheet. On this basis, more likely than an inflationary episode is a default spiral in which USD denominated assets experience a liquidation event, a fire sale in which investors rush to exit assets like treasury bonds.

Debt spirals often collapse the standard of living very quickly while recovery can take decades as it did post-Depression. In a sense, everyone pays for the debt collapse, both old and young. Further, as it is the Baby Boomers who possess the vast majority of USD-denominated wealth they stand to lose the most if asset prices collapse in a default spiral.

Bond auctions since 2021 are becoming increasingly unstable because the volume of debt is so great the reliance on large structural buyers (pension funds, central banks, money markets) must absorb excess supply without skipping a beat or accidents happen. Basically, as debt is rolled off the shelf it must be gobbled up quickly by big buyers or interest rates (the payoff demanded to buy the debt) quickly rise. Something similar befell the UK Gilt market in 2022. Unfortunately, large structural foreign buyers (China, Japan) are exiting the UST market, a harbinger of more to come.

More likely than an inflationary episode is a default spiral in which USD denominated assets experience a liquidation event, a fire sale.

Gold and Bitcoin are Not Options - If you are still with me, this last point might be the most important. Gold prices have massively soared since 2022 and the Chinese have been steadily buying since the Shanghai Gold Exchange (SGE) was established in 2002. 20 years on the SGE now rivals the London Metals Exchange (LME) for control of the gold market. At the same time Bitcoin is growing at an exponential rate, rapidly outpacing the growth of Amazon, Google and other technology networks. Importantly, Gold and Bitcoin represent alternative monetary systems because they bypass the Global Dollar System (GDS).

In the East, it is likely that BRICS+ member nations will peg their currencies to gold and use it to back international transactions (read more here). Doing so can be done outside of Western settlement systems. Bitcoin, on the other hand, will likely be adopted by Western countries where the collapse of the dollar and a frozen credit system will necessitate a new monetary system, especially one that can transact outside of legacy banks and government institutions.

A frozen credit system will necessitate a new monetary system like Bitcoin that can transact outside of legacy banks and government institutions.

There are still more rebuttals to the pressing US debt crisis. One very uninformed rebuff is to say that the Fed can simply buy the entire US bond market, and anything else if needed to stop the bleeding (see below). There is a reason, however, the Fed has been trying to reduce exposure (“Quantitative Tightening”) to Treasuries (+ Mortgage Backed Securities (MBS), and that is inflation. If the Fed is forced to gobble up the entire US bond market it will pump so much artificial money into the USG and banks that the dollar will hyperinflate. Basically, what happened in 2021 but multiples worse.

Some believe US domestic assets like federal lands perhaps rich in oil and natural gas could be leveraged to satisfy creditors. Unfortunately, liquidating sizable holdings of federal property to pay the national debt would pose a national security threat by itself (Remember Uranium One Deal?) and undermine the productive base the USG relies upon to collect taxes.

Then there is the US gold supply, which officially is greater than any other country in the world. Repeging the dollar to gold could be done but that would massively deflate the dollar and cause widespread wealth destruction, a default by another name. Ironically, taking that route would be the inverse of 1971 when President Nixon suspended the gold standard to prevent a default.

As you can see from the points above the pathway to the end of the debt supernova is coming into view. What we cannot know is the exact path we will follow to get there. However, the rate of America’s fiscal decline is beginning to accelerate, which means de-dollarization, inflation, recession, and eventually fiscal default and currency destruction are no longer hypotheticals. At the same time, nations around the world face similar deterioration (Chinese banks, Japanese Yen, EU bond markets). Indeed, the world has not experienced the unwind of a debt supernova like this for 100 years.

What can surmise however, is that whereas the US assumed the monetary reigns of power from Britain at the end of the last monetary cycle, this time America will be dethroned as monetary king. Welcome to the End-of-Cycle.

Stay liquid, stay alert.