Global Margin Call Part 1: Losing Control

Rallies, selloffs, panic and collapse of the everything bubble.

What does the inkblot reveal?

World markets today are a Rorschach test. One minute chaos media churns with violent terrorism in Kashmir, the next a Trumpian tariff onslaught and in between Deepseek shocks Silicon Valley Techbros, and stocks gyrate accordingly. Doomers declare the death spiral of Western capitalism and neoliberal economists celebrate the resilience of globalization. Supposedly “forward looking” markets equilibrate the chaos, there are rallies and selloffs but eventually price tells us where the economy is headed, in theory. So what does the market inkblot reveal at present?

Markets are not forward looking they are reaction machines.

Markets are not forward looking they are reaction machines. Meta-narratives possess investors like psychological demons and reflexivity loops form slowly until the mania becomes an addiction, and stocks, bonds, real-estate or beanie babies and tulips soar higher and higher for longer and longer until the bubble pops with sudden, devastating withdrawal. Today there appears to be a clash of two meta-narratives: Doomers versus Cantillionaires, a financial Vesuvius versus a Wall Street greedfest.

The collision of these narratives is lighting up headlines like the clash of lightsabers between Jedis and Siths on Naboo. US Stocks (and Bitcoin) have made a ferocious V-shaped recovery since April’s panic selloff, nearly taking the S&P back to all time highs and erasing $10T+ losses in record time. Meanwhile, global bond markets continue to wobble on the edge. Since 2020, interest rates have risen meteorically in parallel with government spending and inflation, and the spikes are getting bigger and scarier.

As disconcerting as bond yields (and broader macro warnings) should be markets have shrugged it off even as doubts creep in. What began as thunderous rain showers when the Fed started jacking up interest rates like auctioneers at Sotheby's raising bids on Picasso’s is storming into a Category-4 hurricane. Historically aggressive rate hikes have already caused severe storms slowly intensifying on the Saffir-Simpson Scale:

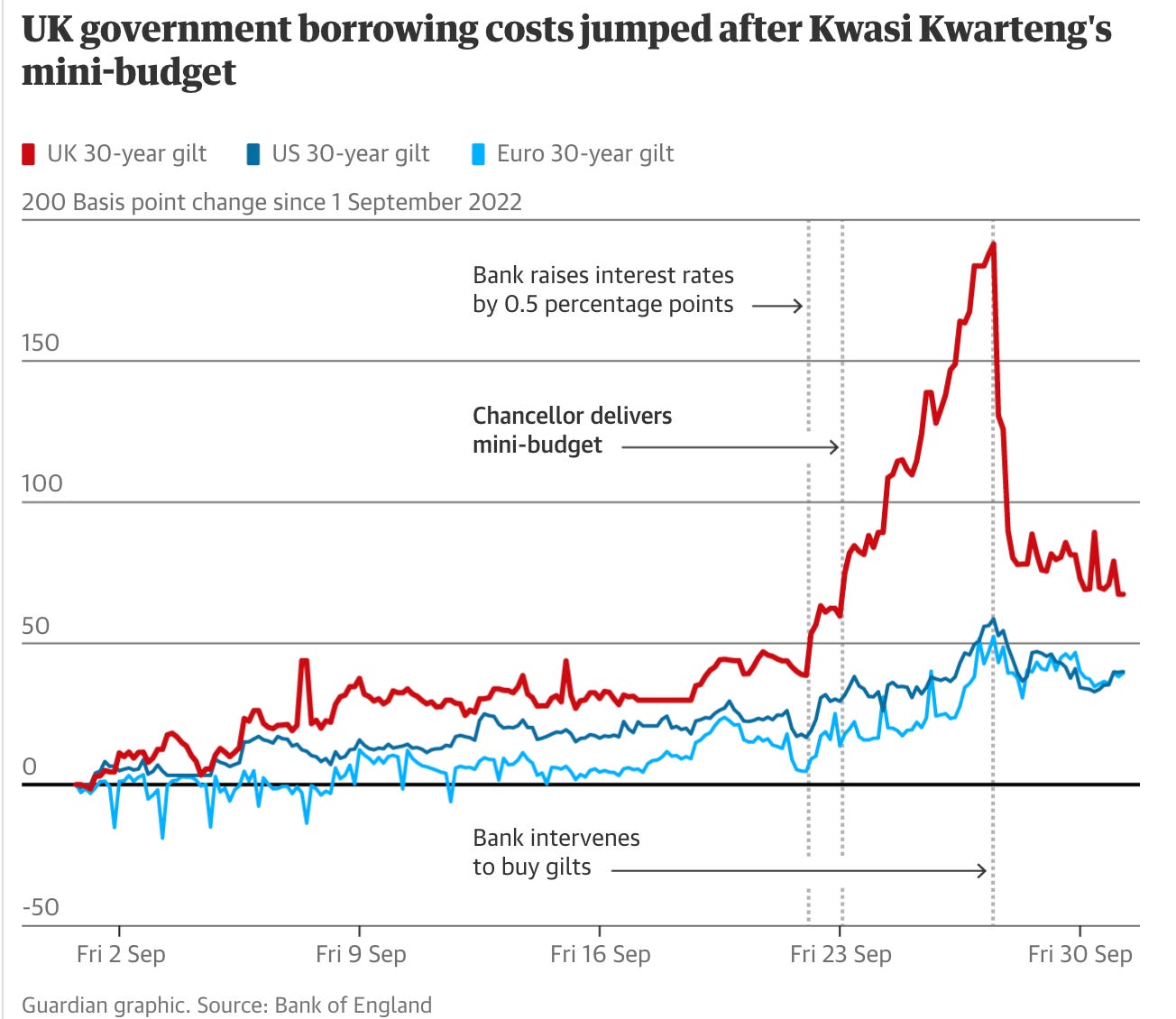

Category-1 - The first victim was Prime Minister Liz Truss, whose 90-day stint terminated in a UK Gilt crisis that nearly broke the Bank of England (BOE)

Category-2 - The second was the bankruptcy of Silicon Valley Bank (SVB) in 48 hours followed by five others including First Republic

Category-3 - The third incident was the unwind of the Yen Carry Trade (YCT) last August, sparking a sell off that made CNBC economists like Jeremy Siegel slip into on air panic attacks

Category 4 - The fourth and least discussed is the default of the City of London in January when the London Bullion Market Association (LBMA) delayed (failed) delivery for physical gold after demand surged

At the risk of mixing metaphors, these tremors are part of something bigger unfolding before us, a financial Vesuvius that will destroy perhaps the longest running bull market in recorded history and the Global-Dollar-System (GDS) along with it. Remember, the global bond market has doubled in value since 2008 and global equities have quadrupled in the same time frame. Clearly, no one wants the party to stop but signs of a death knell are becoming unignorable. Wherever one looks, North or South, West or East, tremors are vibrating. A global margin call on the “everything bubble,” a fire sale of stocks, bonds, real-estate, homes, cryptos etc. is close at hand, and with it the dawn of the next monetary order.

Japan’s Experiment Gone Wrong!

Japanese markets might be the Richter scale for the global financial system. Technically, Japanese Government Bonds (JGBs) are the world’s third largest bond market but the Bank of Japan (BOJ) is the number one holder of sovereign bonds in the world, a point that will come to count with financial ferocity. The BOJ has practiced aggressive Yield Curve Control (YCC) (buying bonds to artificially prop up bond prices thereby lowering interest rates) and currency manipulation (“quantitative easing”) since the Nikkei bubble popped in the early 90’s, a dangerous form of chemo finance Western governments replicated post-2008. On the surface, the gambit worked and convinced mainstream economists, retail traders, and institutional investors that Japan’s stability (and global stability) is guaranteed by monetary magicians (central bankers) no matter what happens. Recent events say otherwise.

The 2020’s has been a decade of impossible reversal. After years of imperceptible inflation and zero-bound interest rates, the Yen has begun to fall and JGB rates have begun to rise; I emphasize begun. Both trends converged in a reversal of the YCT (borrowing on the cheap in Yen to buy higher yielding assets and pocketing the profit) last August. When the dynamic reversed hundreds of billions (no one knows how big exactly) of dollars were caught off sides, and lightning sales of US stocks and other assets struck seemingly overnight.

As disruptive as the YCT reversal was to global stocks, the epicenter of Japan’s fragility is still its bond market, a market artificially dominated by the BOJ (+50% of JGBs are owned by the BOJ). In recent weeks a series of poor auctions for long-duration bonds (20YR, 30YR, 40YRs) demonstrated the weakest buyer demand in 20 years. According to Chief NAB economist Sally Auld, investors are alarmed:

“It sort of feels a bit like the perfect storm for the JGB market at a time when generally investors seem to be a little bit more alert or a little bit more worried about the long-end of yield curves in general and rising term premiums."

Sally Auld, Chief Economist NAB

Last month’s surprising moves are not unprecedented. Weston Nakamura, A Blockwork’s analyst started covering erratic moves in JGBs in 2023. Nakamura observed massive volatility (by Japanese standards) in interest rates as the Yen began to inflate for the first time in a quarter century. Despite its prowess, Nakamura warned the BOJ was already trapped in an intractable quandary: raise rates to slow inflation and kick-start fiscal Armageddon, or let inflation erase the Yen and cripple Japanese consumers in the process. It seems there was a third even more disastrous path involving both higher inflation and higher interest rates. As the “pioneering central bank,” the BOJ’s failure is a paradigm destroying shift. Basically, policymakers are discovering central banks no longer control interest rates or inflation (if they ever did) and market forces are taking over.

The BOJ’s failure is a paradigm destroying shift.

Unfortunately, Japan’s situation is not the exception it is the rule. Central banks the world over are seeing inflation remain stubbornly high and interest rates continue to rise regardless of the monetary tools they deploy. Importantly, demand for government debt is evaporating globally because the world is hitting debt capacity, the moment when creditors simply stop funding the debtor. The fact that even in a high trust society where Japanese citizens blindly own most JGBs is not enough to avert catastrophe should frighten Western technocrats. Higher yields in the US and UK, France, Italy and Germany etc. are ticking time bombs set to eviscerate the brittle social trust they have worked decades to dismantle. Trust in the system has not broken down completely yet but it is only a matter of time before the masses realize they have been hoodwinked by monetary trickery.

Beware of Euros Bearing Bonds

Europe and Japan are on opposite sides of the world geographically but financially they are bedfellows. Prime Minister Shigeru Ishiba acknowledged the same, “Our country’s fiscal situation…is worse than Greece’s.” He meant Greece fifteen years ago when Michael Lewis penned an article for Vanity Fair called “Beware of Greeks Bearing Bonds.” At the time, the eurozone was in free fall because Portugal, Italy, Ireland, Greece, and Spain (the so-called PIIGS) had gone on a drunken borrowing and spending spree that threatened to bring down the eurozone full stop. Parasites like Goldman Sachs slithered in to exploit the binge, as they always do:

“The machine that enabled Greece to borrow and spend at will was analogous to the machine created to launder the credit of the American subprime borrower—and the role of the American investment banker in the machine was the same. The investment bankers also taught the Greek-government officials how to securitize future receipts from the national lottery, highway tolls, airport landing fees, and even funds granted to the country by the European Union.”

Michael Lewis - “Beware of Greeks Bearing Bonds”

We know the rest of the story: economies recessed, riots erupted, governments fell but eventually the eurozone was patched up (sort of) by a series of bailouts, austerity measures, and “whatever it takes” money printing by the ECB. What resulted was another deceptive “liquidity management” facility called TARGET-2. Like QE and TARP in the US the root of the problem (financialization) was never addressed it was simply covered up with more financialization, more opaque financial schemes. Predictably, TARGET-2 was just another disguised springboard for more debt, more deindustrialization, more “climate controls,” further enriching euro elites at the expense of impoverished average Europeans. What started as a Greek tragedy has gone continental.

You might say we are all Greeks now. Certainly, that was the sentiment of former French Prime Minister Michel Barnier who resigned last year over budgetary disputes. Barnier, rather like a distant predecessor Jacques Necker, pleaded for urgent fiscal reforms to avert catastrophe. In 1781, Necker, the Director-General of Finances, published the first national budget in France called the Compte rendu, a public exposé of the Ancien Régime’s grift machine run by “hostile ministers, courtiers, parlementary magistrates, clergyman, and financiers.” Three months after releasing the budget, Necker was fired by the King’s ministers; apparently, disclosing palace intrigue doesn’t pay. Who knew?

Like Necker, Barnier was pushed out by the National Assembly so the grift could continue uninterrupted. While the EU accepted France’s new budget stripped of Barnier’s reforms the bond market is the final authority and yields continue rising in France and across the eurozone because markets forces are not satisfied. Remember, bonds are crucial because they provide stable collateral that banks use to anchor the financial system and governments use to finance deficits. As such, the value of Treasuries, Gilts, Bunds etc. must be stable (low volatility) and liquid (there is always a buyer). Both variables are coming under strain and interest rates, mortgage rates, and credit card rates etc. are skying high in unison as a result. How high will they go?

Trump’s “Liz Truss” Moment

The default program to anesthetize the debt doom loop has been “pro-growth” policies. These come in various forms like deregulation, tax cuts, and ironically enough, more fiscal spending, a formula that won popularity in the eighties with Thatcherism in the UK and Reaganomics in the US. Since then it has become a dangerous consensus that economic growth is the antidote to fiscal recklessness when the last 50 years demonstrates quite the opposite. The same playbook was applied by the unsuspecting Liz Truss in 2022 with calamitous consequences.

Thatcherism and Reaganomics have become dangerous formulas in heavily financialized economies.

After a decade of stagnation capped by surging inflation, the rookie Prime Minister was tasked with turning a battered UK economy around. To do so, Truss and Finance Minister Kwasi Kwarteng repackaged Thatcherite dogma: deregulation, tax cuts, and more spending. Truss and company did not realize the economic landscape had completely changed, that the UK’s debt to GDP ratio had exploded, its industrial output was moribund, and its middle class was bankrupt. Further, Truss and the UK elite seemed utterly clueless about Britain’s financial vulnerability, especially the impact of the Bank of England (BOE) rate hikes on a desperately indebted country.

As bond investors fulminated against Truss’ irresponsible budget, cracks in the financial system spread. Pension funds who had crowded into Gilts to cover up ballooning liabilities were forced to quickly sell holdings of government bonds. Sort of like Japan’s YCT, this time it was the reversal of a strategy called Liability Driven Investment (LDI), a gamble in which pension fund managers used Gilts as leverage for risky behavior. It was a calculated bet that assumed rates would stay “lower for longer” and the value of UK Gilts would stay high and go higher. It did not pan out that way.

Truss found herself in an overnight fiscal emergency. When pension funds dumped large numbers of Gilts interest rates went through the roof. After an emergency meeting, the BOE quickly learned the entire gilt market, plus pension funds and the banking system itself would buckle unless they intervened. So they launched the Asset Purchase Facility (AFP) to buy Gilts and stop the panic, more chemo finance. The BOE’s intervention worked, temporarily, and staved off fiscal implosion, but Liz Truss stepped down as PM less than 50 days into her tenure; she was the collateral damage.

An eerily similar shock surprised the Trump administration in April. Driven by the same bankrupt thinking as Truss’ confidants, namely that deregulation, tax cuts and America’s economic caché were enough to thwart the debt boogeyman, Trump 2.0 has forgone structural reforms to obvious fiscal sinkholes, specifically entitlements and defense. In the same breathe, Trump advisors like Steve Marin crafted a new, more bellicose America First Investment Policy rooted in the outmoded belief that the “United States has the world’s most attractive assets, in technology and across our economy.” So they launched a global tariff assault to bring “foreign adversaries” like China to heel.

Trump’s blanket tariffs are one of the most asinine self-inflicted blusters in US history.

Within days of unveiling one of the most asinine self-inflicted blusters in US history, Trump’s blanket tariffs triggered a financial crisis. The assumption was that Global South trade unions and non-Western economic blocs would quickly dissolve under tariff pressure even if US stocks sold off. They also believed the dollar would strengthen and money would flow into US Treasury coffers as investors sought safety in American assets, as they have for half-a-century. Instead, the bond market began to shake and the DXY fell because foreigners accelerated their de-dollarization. Basically, Trump’s plan backfired and he was forced to suspend tariffs almost immediately.

On the Threshold of Chaos

According to Greek mythology, Khaos represents the abyss, a “primordial void” that preexisted the creation of the cosmos. As such, chaos was not a God or angel, nor something demonic as much as a mirror into the collective unconsciousness of the immaterial realm; a state of becoming, less so of being. When you stare into the abyss what stares back at you is a self-projection. What the non-western world sees in the abyss is the emergence of a Multipolar Monetary World Order (MMWO) and the demotion of an erratic superpower in obvious decline. Conversely, the deranged and insecure gerontocrats who run the West see a “rules based” financial order under siege and a dollar milkshake machine that will put the house back in order.

Western economy is a slop of superfluous fintech, algorithmic trading, and bankrupt government programs propped up by chemo finance.

Out of the chaos before us is a global landscape utterly transformed. Today, Sino trade routes traverse the world and Chinese manufacturing, supply chains, and technological innovation leads the global pack. Equally, the BRICS+ trading bloc commands the infrastructure, industrial capacity, and the agro-commodities critical for real economy. Western economy, by contrast, is a slop of superfluous fintech, algorithmic trading, and bankrupt government programs propped up by chemo finance. Ironically, all that stands between the West and financial Armageddon is brand Americana.

Trump’s maestros of chemo finance are the disciples of Gordon Gekko. They believe that money and value like gender and nations are artificial constructs, inventions determined by narratives, “soft power” propaganda and “art of the deal” hype. “Its all about bucks kid,” says Gekko:

“Money is not lost or made it is simply transferred, one perception to another, like magic. This painting here, I bought it ten years ago for sixty thousand dollars. I could sell it today for six hundred. The illusion has become real, and the more real it becomes the more desperate they want it. Capitalism at its finest.”

“We make the rules pal. The news, war, peace, famine, upheaval, the price of a paper clip. We picked that rabbit out of the hat while everybody sits out there wondering how the hell we did it. Now you’re not naive enough to think we’re living in a democracy are you buddy? It’s the free market and you’re part of it.”

Gordon Gekko, Wall Street

Clearly, Donald Trump, Steve Marin and Howard Lutnick would agree. So when they look into the abyss, what they see in the chaos is America’s money machine lording over the de-dollarizing world. We are holding all the cards: we have the most powerful military, the most innovative economy, the most “democratic” system, and we are the guarantor of global peace and economy, so they think. That world, if it ever existed, is over. Even said, the chief danger to the world is a reactionary Western elite desperately clinging to a bygone global order disintegrating before them.

The global margin call has begun but markets have not yet relented. The MMWO is on the horizon but a Perfect Storm stands before us and our destination. How will the “everything bubble” unwind in the months ahead? What counter-measures can be deployed to delay the inevitable? What crazy things could happen as the end-of-cycle climaxes? These questions and more will be addressed in Part 2.

Stay liquid, stay alert.

Bravo.

Great article. Ive been going ham into physical silver (pre 1964 dimes), canned goods, ammo (sorry eurofags), and heirloom seeds. Something wicked this way comes.